Hypercompetitive business environment and breakneck speed development of automation technology makes business from various industries devise new strategies of successful customer relationship management. Financial sector in particular, is oversaturated with different services and each institution is trying to outcompete the other to deliver excellent customer service and increase customer engagement. However, the majority of banks are offering somewhat identical services that can only be differentiated through their names and their marketing positioning. The experience of the biggest heavy-hitter in financial industry has shown that the only way for your organization to succeed is to utilize a customer-oriented approach to all of bank’s business operations.

The automation of credits and loans are the leading areas that a lot of banks are focusing on. At the same time, financial organizations are forgetting that establishing long-term relationships with your patrons requires a comprehensive automation of marketing, sales and customer service on single CRM platform. So, what are the best ways of enhancing your business operation if you want to minimize the risks and increase revenue? You will need to combine customer-centric approach with personalized customer service. Top-notch CRM in banking is capable of providing a comprehensive view of all your clients, which makes it easier to identify their needs and preferences. Hence, delivering the service they need at exactly the right time. Let’s take a closer look at the few areas that CRM in banking can actually improve upon:

CRM in Banking Improves Marketing Campaigns

One of the biggest obstacles that various financial organizations are facing nowadays is the lack of customer related information, lack of analytics that would indicate your target audience when promoting new products and services and so forth. The result is quite predictable: without all of this data, a lot of marketing budgets will be lost, as all of your marketing efforts will be aimed at the wrong direction. It is crucially important to realize that you need to run your marketing campaigns with surgical precision instead of utilizing a shotgun strategy. However, the implementation of a suitable CRM solution can amp up your marketing game. In order to deliver a truly personalized customer service, you need to have a 360-degree overview of your clientele.

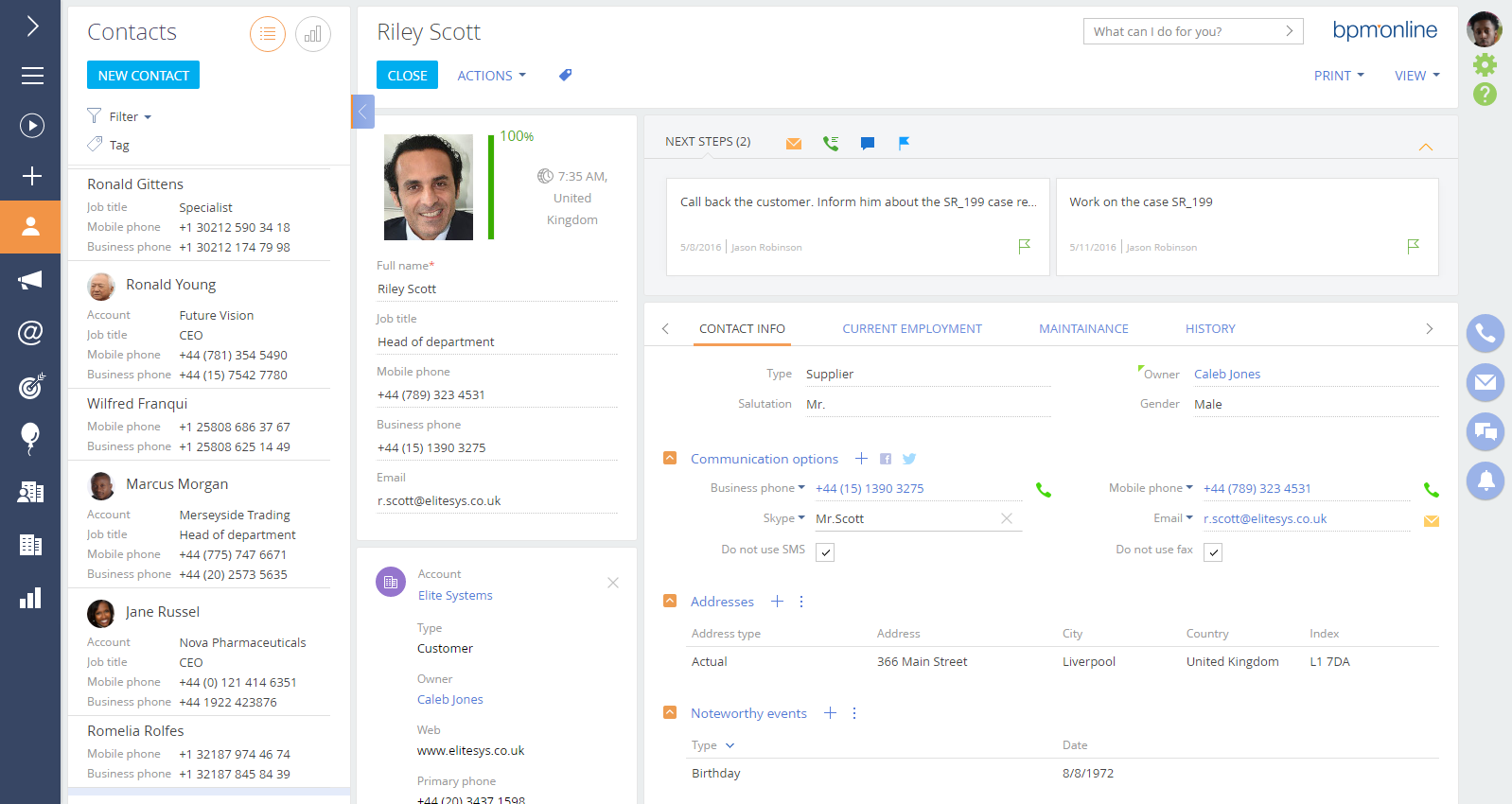

In this case, Financial CRM is equipped with excellent contact management tools. You will be able to manage an extensive database that contains various customer related information like their names, contacts, their career history and history of interactions with your employees. You can also extract additional information from social networks like Facebook and Twitter. Moreover, your advanced CRM is armed with tools for website behavior tracking. That way you will get valuable information on your potential and existing customers, as the system tracks what section of the website the visitor was most interested in, how much time they spend there, their location and time of visit. All of this data is crucially important for future interactions. For instance, having such a complete view of your patrons, you will be able to utilize this data while running your customer retention campaigns or developing truly personalized marketing campaigns. If having a 360-overview of your customers is one of your bank’s top priorities, you should consider adopting a CRM solution that easily customizable and has extensive API to provide any required integration.

CRM in Banking Improves Customer Support

We are living in the age of the customer, where customer satisfaction has become an actual business objective for businesses to achieve. At the same time, modern customers are extremely demanding and do not seem to be forgiving poor customer experience. They do not like to give second chances, and 20% of customers switch vendors immediately after the first poor experience. The need of decreasing customer attrition while increasing customer retention has never been more transparent. Customer are expecting the banks to make their life easier and need to get required information from various communication channels. Traditionally, bank customers can be serviced through a number of communication channels that include but are not limited to ATMs, branches and online banking. Obviously, financial institution provide customer support via contact centers.

The main problem with these channels that all of them are operating in their own silos, which means that your clients may not receive the same quality of provided services. It is paramount for any bank to deliver the highest level of customer experience regardless of the media your patron prefer. That is why it is necessary to utilize an omnichannel approach to servicing your clientele. Bpm’online is one of the best CRM solutions for financial industry. CRM in banking makes it easier, as it is equipped with tools like communication panel that enables your customer support agents to chat, call and write messages directly from the system. Moreover, having that 360-degree overview of each client at your disposal, will liberate your patron from providing the same information and repeating the same inquiry on multiple stages of case management. Instead, your customer support agent will be able to solve the problem on the first point of interaction, which will result in improved customer experience.

See also

- How To Optimize Your Customer Relations Using Banking CRM

- Top 5 Banking CRM Software Solutions

- Tips on building Email Marketing strategy for Banks

- Banking CRM Software: From Accounts to Complicated Transactions

- Banking CRM software